Unclaimed Property Holder Due Diligence v. Asset Recovery Letters

Each year in the United States, billions of dollars are escheated to the states. Nationwide, the total value of escheated properties in state custody may well exceed $40- $50 billion. However, even more unclaimed property sits dormant at government agencies, counties, municipalities, courts and other local agencies that will never be reported to the states as unclaimed property.

Before an item is reported to the states as unclaimed property, outreach in the form of statutorily mandated due diligence letters must be mailed to the last known address of the owner. However, property held by counties, municipalities, or courts may not be subject to state unclaimed property laws. In these instances, no communication to the owner is required. However, companies may receive letters indicating they are the owners of funds being held by these entities (an “Asset Recovery” letter.) Asset Recovery letters are typically sent by third party firms attempting to help your organization recover monies you did not know you were owed.

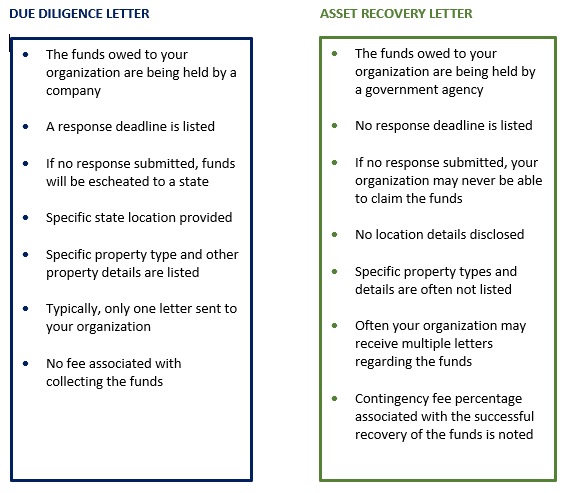

So how does an organization distinguish between a statutorily required due diligence letter and an asset recovery letter?

The following table shows the different characteristics of these letters:

It is critical to know the differences to ensure you are handling both types of letters responsibly. Each letter has a different purpose, but both can be valuable ways to ensure your organization is receiving all unclaimed funds potentially due to your organization.

If you have you recently received a due diligence or an asset recovery letter and have questions or would like to know more about how to proceed, visit MarketSphere or Contact Us for further formation and to learn more about the best way to manage your response.

If you received a letter or an email, please check out our FAQ section to learn more about next steps.

We offer a customized approach to fit your specific needs.